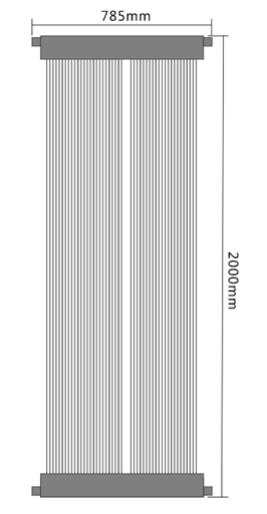

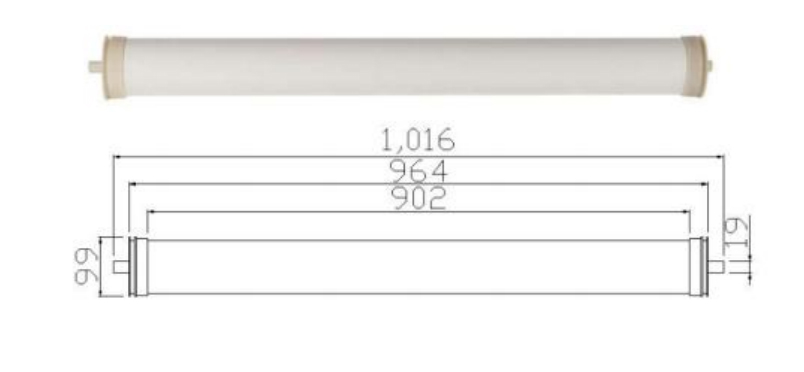

PPG Industries Inc. PPG recently introduced high-performance ultrafiltration (UF) membrane and filter components for industrial process water and wastewater applications. The UF membrane expands PPG's line of microfiltration (MF) membranes and filter elements, which are designed to remove oil and other contaminants so that process water and wastewater can be disposed of or reused safely and economically, contributing to addressing global water scarcity. PPG's UF membranes are superhydrophilic, or water-loving, and have a proprietary antifouling treatment technology, which prevents difficult-to-filter pollutants from fouling the membranes and filter elements. As a result, the service life of membranes can be extended, resulting in decreased maintenance and replacement expenses. High-performance MF and UF membranes from PPG separate oil, grease and emulsified pollutants from larger volumes of industrial process water. This can reduce the number of filters and manufacturing floor space required to recover and reuse water. PPG membranes, when combined with an antifouling treatment, can provide plant managers and maintenance engineers with a solution that allows their filtration systems to function better and last longer while also being easier to clean. The ability to clean and reuse industrial process water is advantageous in a variety of ways, not only for the enterprises that recapture this valuable resource but also for the environment by lowering demands and stress on freshwater supplies, PPG noted. Shares of PPG have gained 13.2% over the past year compared with a 13.2% rise of its industry.

Image Source: Zacks Investment Research Mbr Plant

The company expects adjusted EPS for the third quarter to be in the range of $1.85-$1.95. For the full year, the company raised its adjusted EPS projection to the range of $7.28-$7.48. These projections consider various factors such as current global economic activity, soft global industrial production, continued economic uncertainty associated with geopolitical issues in Europe and higher interest rates in most developed countries. The company expects performance coatings demand in Europe to stabilize at lower levels than the pre-conflict period in Ukraine while raw material and transportation normalize closer to pre-pandemic levels. For Industrial coatings, PPG anticipates a low single-digit percentage decline in organic sales due to lower global industrial production, except for modest growth in China. Other industrial end-use markets are expected to be soft. However, selling price increases are expected to continue.

PPG currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, The Andersons Inc. ANDE and Hawkins Inc. HWKN. Carpenter Technology currently carries a Zacks Rank #2 (Buy). The stock has rallied roughly 79.8% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here. Andersons currently carries a Zacks Rank #2. The stock has gained roughly 50.6% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. Hawkins currently carries a Zacks Rank #1. The stock has rallied roughly 49.1% in the past year. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 25.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Ultra Filter Membrane To read this article on Zacks.com click here.